Overview

India is the third largest energy consumer in the world after China and US. Its primary energy mix is still dominated by coal and oil. The natural gas share is just 6 per cent in the energy mix. However, globally gas share stands at an impressive 24 per cent.

One reason for low gas consumption is that India produces only 45 per cent of its gas requirement. But as India transitions to low carbon economy, the Indian government is committed to increase up the share of natural gas to 15 per cent by 2030. As a result, 2.5 times jump in the consumption of gas is envisaged. Covid-19 threw a spanner in the works as the total gas consumption in 2020-21 was lower than that in 2019-20.

Nevertheless, the gas outlook looks promising. Given that there are very few domestic sources of gas available, the country imports natural gas in liquefied form as liquified natural gas (LNG) and re-gasifies at its terminals before transporting it across its pipelines to gas consumers.

The LNG imports have been increasing as a percentage of total gas consumption due to the stagnant domestic gas production as well as also because of imported LNG being lower priced than domestically produced gas. Last year, the country imports 24.8 million metric tonnes per annum (MMTPA) of LNG majorly from Australia, Qatar and Algeria. It plans to increase its import volumes to 70 MMTPA in the coming years, which will make India second to Japan in terms of volumes of LNG imported every year.

To boost gas consumption within the country, increased gas infrastructure including pipeline, import terminals and City Gas Distribution (CGD) facilities are being planned. The government is also ensuring demand push from industrial, domestic, commercial and transportation sector especially through expanding city gas distribution network and CNG vehicles.

The Petroleum and Natural Gas Regulatory Board (PNGRB) has already allotted 238 geographical areas (GAs) under 10 rounds of bidding to expand CGD network. Besides, the central Ministry – the Ministry of Petroleum and Natural Gas (MoPNG) – is pushing use of compressed natural gas (CNG) and Liquefied Natural Gas (LNG) across major sectors. Moreover, draft regulations for operating gas exchanges and free gas market have also been issued. These initiatives entail growing gas demand and market in the country.

Gas Demand

The demand for natural gas in India has increased significantly due to its higher availability, development of transmission and distribution infrastructure, the savings from the usage of natural gas in place of fossil fuels, and most importantly the environment friendly characteristics of natural gas. Power and fertilizer sector remain the two biggest consumers of natural gas accounting for over 60 percent of gas consumption. The balance is consumed by the petrochemicals and other industries, as well as city gas distribution (CGD) for vehicles and domestic consumption. India’s demand for liquefied natural gas (LNG) is set to rise by about 13 per cent in 2020-21.

Noteworthy is the fact that CGD sector’s share of gas demand that currently stands at 19 per cent is expected to grow at a CAGR of 8-10 per cent between the fiscal years of 2020-2030. This demand will mainly be driven by increasing number of vehicles, domestic households, industrial and commercial sector.

LNG Import Infrastructure

With imports touching 25.6 MMTA in 2020-21, India has become the fourth largest importer of LNG in the world. Currently, LNG is imported in India through mix of long term, short-term and spot basis. A number of new infrastructure including regasification terminals and natural gas pipeline are being developed in various parts of the country, which would strengthen the development of LNG market in India.

LNG Terminals: There were only two terminals in the past (Petronet’s LNG Terminal and Shell’s Hazira Terminal), Currently, there are seven LNG terminals with the regasification capacity of 47.5 MMPTA receiving the super-chilled fuel.The government is planning to include 8 more terminals in the next 15 years. India’s regassification capacity is expected to increase to 55 MMTPA by 2025. All major players including Shell, TOTAL, Saudi Aramco, AG&P etc. have shown interest in investing into India’s natural gas future. However, setting up a full-fledged LNG regasification terminal comes with its own set of challenges. Knowledge of potential consumers, identification of demand centres, and connectivity to the national gas grid will be major concerns an investor might face in monetizing the imported LNG.

Natural Gas Pipelines: India’s gas transmission pipeline network is of 17,900 km with GAIL having a 70 per cent share. In the past, pipeline development infrastructure only developed where gas supplies and demand centers were located, especially in places such as Gujarat. However, now pipeline network is coming up in eastern and southern part of India with the government creating the National Gas Grid. The pipeline infrastructure is expected to reach around 27,430 km by the year 2025.

LNG Sourcing and Contracts

While the Middle East, in particular Qatar, was the sole supplier of LNG to India till 2004 and remains the largest LNG supplier at present, the range of suppliers is becoming increasingly diverse. India started diversifying its supply portfolio from 2006 onwards and imported LNG from many other countries including Algeria, Nigeria, Yemen, Australia, Trinidad and Tobago, Russia, UAE, Norway, Indonesia and Oman. The country is looking at diversifying its long-term supply portfolio as well and Australia and US are likely to emerge as key LNG exporters.

Earlier the Indian market that is extremely price sensitive was unable to commit to short-term contacts (up to two years) and spot purchases as the country lacked adequate gas infrastructure. However, short-term and spot market accounted for most of the increased LNG supply in the last two years. Going forward, the industry is likely to see an increased trend of procuring LNG through mid-term and short-term contracts as these will be negotiated at rates cheaper than spot prices.

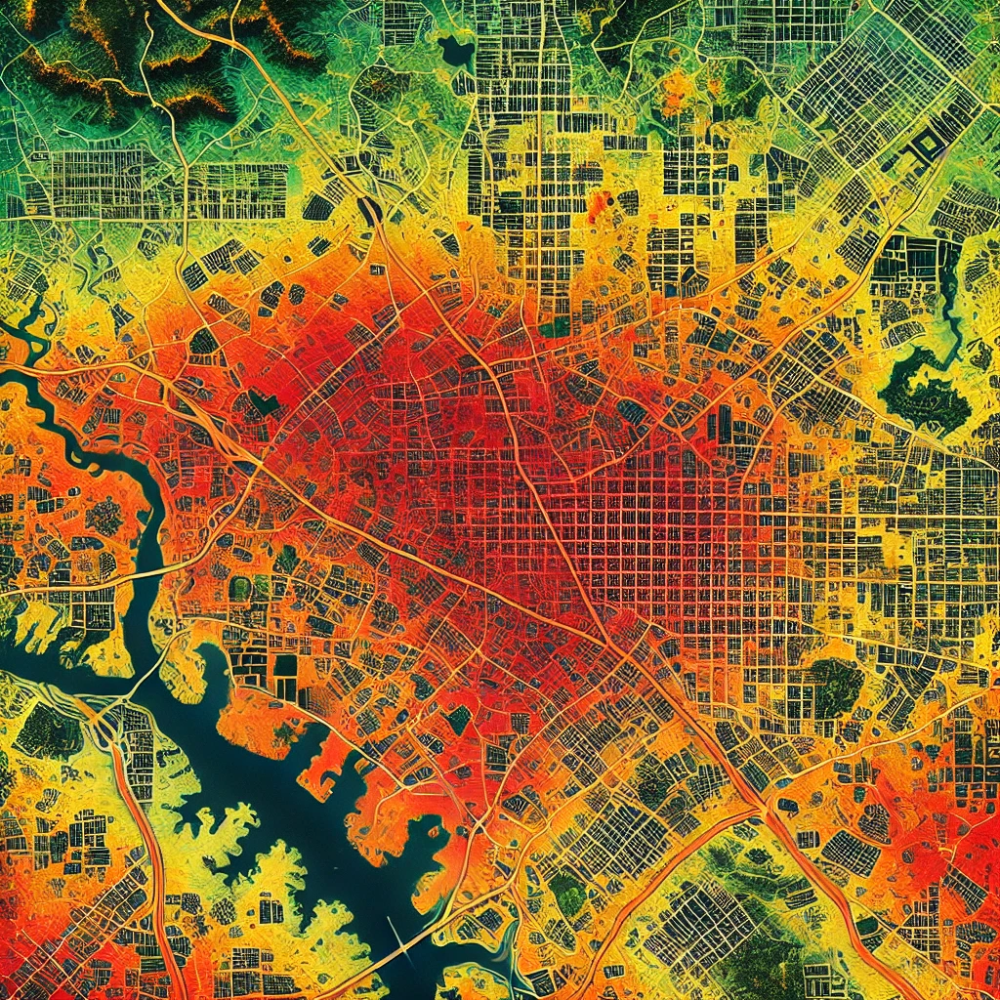

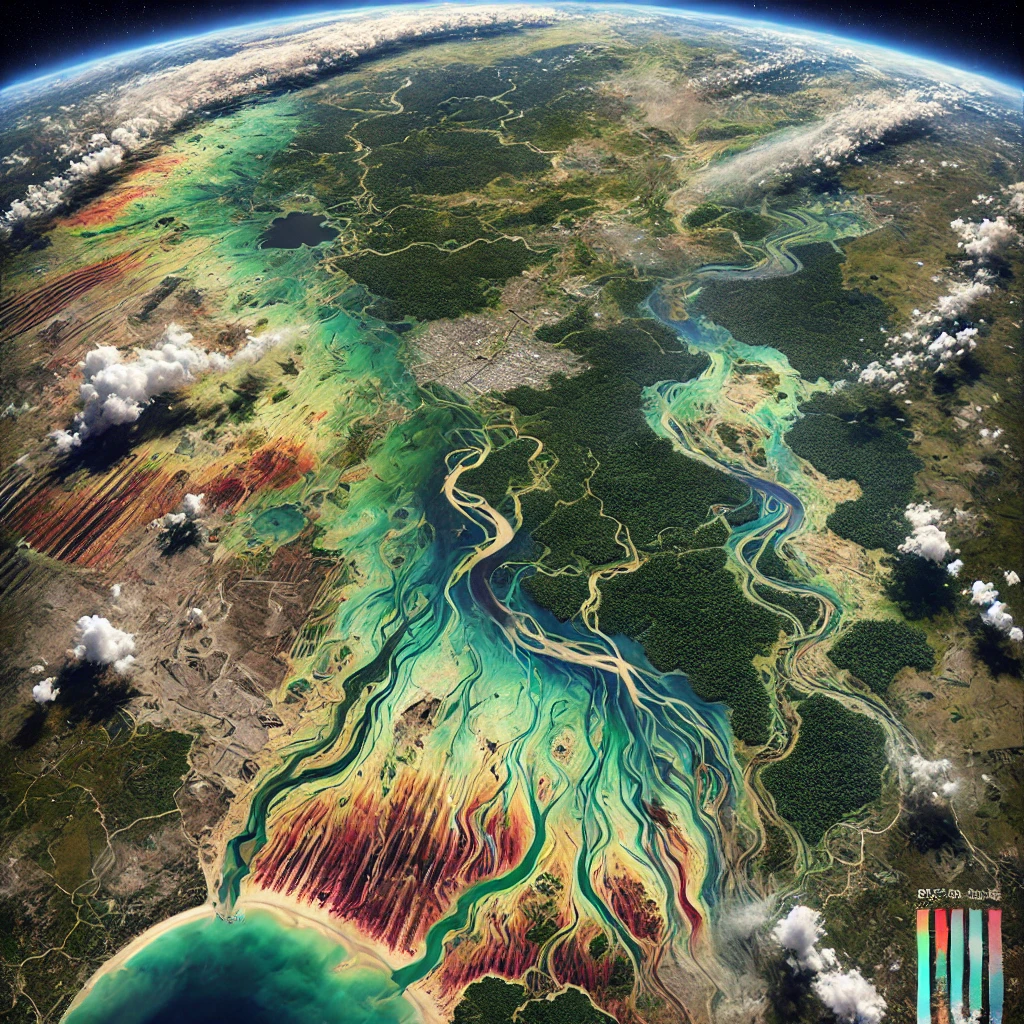

Genesis Ray Tool

With substantial action in the gas sector, the need of a GIS-based platform to make more informed and accurate decisions cannot be understated. A new GIS-based tool GenRay EXPLORER™ promises to help make innovative and cost-effective decisions saving precious time, money and energy. Covering all elements of the gas value chain, this GIS-based tool through its powerful data visualizations and intelligence provides exact locations of gas-based power, fertilizer and petrochemical plants.

The information contained in GenRay EXPLORER™ helps the investors make decisive insights on the positioning of upcoming LNG terminals and routing of regasified LNG pipelines linking the major demand centres. It assists users to choose the most suitable sites for installing gas-based projects. Along with its built-in power transmission infrastructure, it is used to identify the best possible site for sourcing natural gas along with identification of nearest power grids to transmit power from newly installed power projects. The tool has useful widgets such as search and query, base map gallery, infographics, near me, and 3D options that give great flexibility for interpretation and analysis.

Upstream: The upstream layer includes precisely mapped 550 plus active gas blocks, 250 plus active gas fields and 80 plus gas processing plants spread across 26 sedimentary basins of India. (Note: Gas processing plants serve as a medium of uninterrupted gas supply both to the national gas grid and to the standalone commercial consumers). Each block, field and GPP have its own set of technical and financial information like owner, operator, investment, year of commissioning, reserves, processing capacity, EPC etc.

Chart 1: No. of Blocks by Commissioning Year

Midstream: GenRay EXPLORER currently has more than 17,000 km of precisely mapped pipelines and over 650 pipeline facilities distributed across the country. The tool has pipelines mapped to all the major gas consumers such as power plants, fertilizer plants, petrochemical plants, automobile plants etc. Through the tool, one can discover the exact Right-of-Way (RoW) for all the trunk pipelines and the major spur lines which cater to the demand of the major industries. Section-wise technical and volumetric information on all the trunk and major spur pipelines is also available on the tool. The trunk pipelines extended up to the City Gate Station (CGS) point, from where the gas is either used as PNG or into the CGD network.

Chart 2: No. of Onshore GPP by Basins and Operators

Besides, all the pipelines are marked with major pipeline facilities such as Intermediate Pigging Station, Compressor Station, Block Valve Station, and receiving/dispatch Terminal.

Map 1: Gas Pipeline Network in Indian Subcontinent

Downstream: The downstream layer includes demarcation of all the Geographical Areas within a country in order to distinguish the areas operated by different companies along with details such as bidding rounds, gas procurement method, pipeline connected and more. It also includes the major gas consumers like power plants, fertilizer plant, petrochemical plant and information on all the Industrial Parks, which are connected to the national gas grid via a spur line, essentially meaning they have a supply of Piped Natural Gas (PNG) for existing industries and for upcoming industries, along with their precisely drawn layouts.

LNG: Besides the three verticals, the tool also pinpoints all the LNG liquefaction and regasification terminals with technical details on more than 25 parameters along with their EPC, financial and importing country details. Using GenRay EXPLORER, one can pinpoint all LNG terminals in India. The technical database captures data on more than 30 technical parameters on all types of LNG infrastructure.

Some specific used case examples of the Genesis Ray tool are below:

- Upstream Bidders: The tool can be used to get an approximate idea about the prospective location for bidding a block/field within a basin by taking cognizance of the nearest gas processing plant, its gas processing capacity and pipeline infrastructure in the region to evacuate the gas hence produced. It also gives the information about nearby existing/potential gas consumers, and their gas consumption data.

- Geographical Area Bidders – The tool help bidders to identify potential Geographical Areas by providing analytical information about capacity utilization of the nearest trunk pipeline, proximity from the nearest Tap off, which can be used in tariff calculation for gas purchased from the supplier, and gas procurement modes other than pipeline, such as CNG Cascades, for initial few years till the pipeline infrastructure becomes operational.

- Project Developer – The tool gives a comprehensive view of natural gas infrastructure in and around the existing and prospective project locations by providing detailed information about nearby pipeline infrastructure, land use pattern and proximity from the nearest possible tap-off-point as well as information on various gas suppliers in the vicinity.

- Educational Institutions and Government Bodies – The all-in-one platform for gas infrastructure, makes this interface unique and a go-to place for all the research students at different institutions. Government bodies can also make use of the tool for tracing developments within the sector in a single environment thereby reducing the time and effort to visit multiple sources for finding different types of data.

Genesis Ray’s Consulting Offerings

GRE also provides be-spoke consulting using its GIS tool for specialised client needs. It has a dedicated consulting team for the gas sector to address several kinds of challenges in upstream, midstream and downstream sector. To be sure, the team has competency in site selection and project development; market entry strategy; project feasibility and due diligence; gas monetization; structuring and development; and risk and strategy.

To sum up, being a cleaner and cheaper option, the India government seems committed to increase gas share in the energy mix in its move towards a carbon free future in the country. With this, more investments in gas infrastructure through the National Gas Grid is being envisaged. The Gas demand is also being bolstered through other interventions.

With its data visualisation intelligence and power of analysis, GenRay EXPLORER™ tool is well-positioned to help make critical decisions to give an undisputable cost-effective and analytical edge to its users. Potential users, hop on to a complimentary viewing of the Gujarat energy profile on the tool by visiting on to www.genesisray.com.